involga.ru

Market

Starbucks Card Scanner

Our beautifully designed Starbucks gift cards are now available for mobile order and pickup! This thank you card has no value until activated. Open the Starbucks Mobile App and select Scan in store. • Navigate to Campus Card within the Scan & pay options. • The barista will scan the QR code as the form. Want to check the balance on your Starbucks Gift Card? See instructions for how to check it instantly online. Starbucks Card app available in the Connect IQ store. This allows you to scan the barcode for your Starbucks Card using your Garmin device. How Do I Get. Get the Spring edition Starbucks card activation with a minimum Top up of IDR K. Make sure to scan each purchase of beverages and food. Click 'Get your gift card' to view card details. Print or scan the barcode on your phone to pay at participating Starbucks® stores. You can also add this. Scan and pay at the register in one step. Say hello Stars cannot be earned on purchases of gift certificate, Starbucks Cards or Starbucks Card reloads. Order in store and scan or swipe your Starbucks card or app before you pay. Collect Stars to earn free drinks - every Stars have a drink on us! Registering. Get a free digital Starbucks Card when you join Starbucks® Rewards, or register a gift card you already have. Sign in. Our beautifully designed Starbucks gift cards are now available for mobile order and pickup! This thank you card has no value until activated. Open the Starbucks Mobile App and select Scan in store. • Navigate to Campus Card within the Scan & pay options. • The barista will scan the QR code as the form. Want to check the balance on your Starbucks Gift Card? See instructions for how to check it instantly online. Starbucks Card app available in the Connect IQ store. This allows you to scan the barcode for your Starbucks Card using your Garmin device. How Do I Get. Get the Spring edition Starbucks card activation with a minimum Top up of IDR K. Make sure to scan each purchase of beverages and food. Click 'Get your gift card' to view card details. Print or scan the barcode on your phone to pay at participating Starbucks® stores. You can also add this. Scan and pay at the register in one step. Say hello Stars cannot be earned on purchases of gift certificate, Starbucks Cards or Starbucks Card reloads. Order in store and scan or swipe your Starbucks card or app before you pay. Collect Stars to earn free drinks - every Stars have a drink on us! Registering. Get a free digital Starbucks Card when you join Starbucks® Rewards, or register a gift card you already have. Sign in.

Tap scan and swipe left. The app will enlist all the default cards linked to your account along the balance. Check Starbucks' Gift Card Balance via Card Page. Join Starbucks® Rewards to earn free food and drinks, get free refills, pay and order with your phone, and more. “It's the first day of school and the Starbucks scanner card thing isn't working,” De Jesus said. Store Manager Torri Hines-Allen said that the issue was. Browse Getty Images' premium collection of high-quality, authentic Starbucks Card stock photos, royalty-free images, and pictures. Starbucks Card stock. - Scan the QR code printed on the gift card carrier or visit involga.ru to activate your gift card. - Enter the gift card number along with your. Can I use my United States Starbucks card at UK Starbucks locations? 2) scanned my electronic card in the Wallet (formerly Passbook) app. Card using Scan & pay in the Starbucks app at Participating Starbucks Stores Starbucks Card eGifts and physical Starbucks gift cards (“Starbucks Cards”). No matter how you pay, you can earn Stars on your order. Earn 2 Stars/$1 with a Starbucks Card, and 1 Star/$1 with cash, credit/debit, PayPal and Venmo. Some. This is a LOT OF THIRTY-TWO (32) Starbucks Winter Releases of BOTH SWIPE and SCAN Gift Cards. You will receive 31 cards (all pictured above) as well as. cards associated with your Starbucks rewards account. In-store: Present digital e-gift card to cashier for scanning. Ask cashier to check its balance. Call. Getting started is easy · Step 1. Download the Starbucks® app. Join in the app to get access to the full range of Starbucks® Rewards benefits. · Step 2. Order and. Get a free digital Starbucks Card when you join Starbucks® Rewards, or register a gift card you already have. Starbucks Rewards points for using it. If you just scan the barcode and pay in-store with cash or credit card, you get 1 point per $1 spent. However, if you. Open the Starbucks Card, tap "Scan in Store" then tap "Scan & Pay" at the top of the screen, then tap "Manage" below the bar code and see if the option is there. Starbucks gift card online and they send you scanning the barcode, however I have heard from friends who have done this that people can “steal” the. When you're ready to unlock more perks (like our best offers, a birthday treat and free in-store refills on coffee and tea), it's always free to join Starbucks®. The Starbucks® app is a convenient way to order ahead for pickup, scan and pay in-store and customize your favorites. Rewards are built right in. Starbucks Card app available in the Connect IQ store. This allows you to scan the barcode for your Starbucks Card using your Garmin device. How Do I Get. Stars cannot be earned on purchases of gift certificate, Starbucks Cards or Starbucks Card reloads. scan your Starbucks Card to capture your account's. I just went to Starbucks and tried out the app. It worked perfectly! When it was time to pay, I had my Starbucks Card up on my Ionic and ready to scan. I said I.

How To Purchase Tesla Stock

Step 1: Decide where to buy Tesla stock. You will need an online brokerage account in order to access the NASDAQ market and buy TSLA shares. You can buy shares in Tesla and other US companies as an investor in Australia by using online share trading apps that offer access to the NASDAQ stock exchange. How to buy Tesla stock on Public · 1. Sign up for a brokerage account on Public. It's easy to get started. · 2. Add funds to your Public account · 3. Choose how. How to Buy Tesla Shares · 1. Use Our Experts' Analysis · 2. Follow Tesla Stock Price History Chart · 3. Choose Your Stock Trading Strategy · 4. Open a Trading. Find new and used Tesla cars. Every new Tesla has a variety of configuration options and all pre-owned Tesla vehicles have passed the highest inspection. We outline the most cost-effective, secure and user-friendly platforms for anyone wanting to buy Tesla shares. How to buy Tesla stock · Choose a stock trading platform. Use our comparison table · Open an account. Provide your personal information and sign up. · Fund your. Invest in Tesla, NASDAQ: TSLA Stock - View real-time TSLA price charts. Online commission-free investing in Tesla: buy or sell Tesla Stock commission-free. To buy fractional shares of Tesla stock, you'll need to sign up for Stash and open a personal portfolio. Step 1: Decide where to buy Tesla stock. You will need an online brokerage account in order to access the NASDAQ market and buy TSLA shares. You can buy shares in Tesla and other US companies as an investor in Australia by using online share trading apps that offer access to the NASDAQ stock exchange. How to buy Tesla stock on Public · 1. Sign up for a brokerage account on Public. It's easy to get started. · 2. Add funds to your Public account · 3. Choose how. How to Buy Tesla Shares · 1. Use Our Experts' Analysis · 2. Follow Tesla Stock Price History Chart · 3. Choose Your Stock Trading Strategy · 4. Open a Trading. Find new and used Tesla cars. Every new Tesla has a variety of configuration options and all pre-owned Tesla vehicles have passed the highest inspection. We outline the most cost-effective, secure and user-friendly platforms for anyone wanting to buy Tesla shares. How to buy Tesla stock · Choose a stock trading platform. Use our comparison table · Open an account. Provide your personal information and sign up. · Fund your. Invest in Tesla, NASDAQ: TSLA Stock - View real-time TSLA price charts. Online commission-free investing in Tesla: buy or sell Tesla Stock commission-free. To buy fractional shares of Tesla stock, you'll need to sign up for Stash and open a personal portfolio.

Discover how to buy and sell Tesla shares, including how to invest in Tesla and how to go short on Tesla stock. The 92 analysts offering price forecasts for Tesla have a median target of , with a high estimate of and a low estimate of To become a Tesla shareholder, you must choose the best brokerage firm. Here are three online brokers to get you started. Tesla Inc. (TSLA), the world's largest automaker by market value, designs, builds, and markets fully electric vehicles (EV) and energy generation and storage. How to buy Tesla shares (TSLA) · Step 1: Choose a broker · Step 2: Decide how much to invest · Step 3: Review TSLA stock performance and potential · Step 4. There are plenty of platforms you can buy Tesla shares on in the UK. For free there are apps like FreeTrade and Trading Investing in tesla shares (TSLA) in Indonesia is easier, faster, with the lowest spread. Triv registered Bappebti. Check Elon Musk's updated Tesla stock. Since used vehicles are available for purchase online, we cannot guarantee the availability of a particular vehicle for your demo drive appointment. We explain how to buy shares in Tesla from NZ trading platforms, and what to consider when investing in TSLA. To buy Tesla stock, you'll need to open an account with your broker and fund it through a wire transfer or a debit card transaction. However, it's important to. You can easily purchase Tesla stock by opening a brokerage account with a reputable platform and funding it. Then, search for Tesla's ticker symbol (TSLA). Yes, Tesla Inc shares can be bought in India by opening an international trading account with Groww. How to Buy Tesla Inc Shares in India? The fastest way to trade Tesla options is by typing into Tesla the search bar. Once you navigate to the Tesla asset page, click the “Trade Options” button. 3. Access real-time $Tesla Motors, Inc. stock insights on eToro. ➤ View Buy. Tesla Motors, Inc. price. % Past Week. Created with Highcharts Depending on what state you live in, you can choose to lease the vehicle, purchase with financing or purchase outright. You may also be able to trade in your. Get Tesla stock quote in real-time, analyze price movement and start CFD trading using our advantages of tight spreads. Buy Tesla stock or sell it on IFC. This guide will introduce how to buy Tesla stock on eToro, an easy platform to purchase securities. Learn the features and steps to begin your journey. Create or log in to your trading account · Go to our 'Watchlists' · Select 'Tesla Options' · Choose the Tesla option you want to trade on according to its strike. I wanted to share my thoughts on whether to buy, sell, or keep holding Tesla stock. The share price has risen meteorically. Since reaching a record-high, it. Analyst Ratings. Sell; Under; Hold; Over; Buy. Number of Ratings 58 Full Ratings. Recent News. MarketWatch. Dow Jones. Read full story. EVs Tesla Stock Is.

Mezzanine Equity

The term “mezzanine” covers a range of financing solutions along the spectrum between debt and equity, with varying degrees of risk and return. Broadly speaking. Mezzanine debt and preferred equity are two important parts of the commercial real estate capital stack. While the two function in somewhat similar capacities. Mezzanine debt goes on the balance sheet as a loan whereas preferred equity is listed as equity. The big difference is the way that each investor realizes their. Mezzanine financing is a sort of hybrid combo between debt and equity financing. The lender will provide capital and collect interest. We offer a range of mezzanine and preferred equity solutions with a focus on institutional-quality real estate in primary markets. Mezzanine finance is effectively a business loan where the debt becomes an equity share after a predetermined timeframe has passed. That means if the company. Mezzanine Debt is generally a loan that is secured by a property and senior to any equity, but junior to the senior loan on the property. Preferred Equity. Here is all you need to know about Preferred equity and mezzanine loans for real estate, how they're structured, and how private equity real estate sponsors. Mezzanine financing is a layer of financing that fills the gap between senior debt and equity in a company. It can be structured either as preferred stock. The term “mezzanine” covers a range of financing solutions along the spectrum between debt and equity, with varying degrees of risk and return. Broadly speaking. Mezzanine debt and preferred equity are two important parts of the commercial real estate capital stack. While the two function in somewhat similar capacities. Mezzanine debt goes on the balance sheet as a loan whereas preferred equity is listed as equity. The big difference is the way that each investor realizes their. Mezzanine financing is a sort of hybrid combo between debt and equity financing. The lender will provide capital and collect interest. We offer a range of mezzanine and preferred equity solutions with a focus on institutional-quality real estate in primary markets. Mezzanine finance is effectively a business loan where the debt becomes an equity share after a predetermined timeframe has passed. That means if the company. Mezzanine Debt is generally a loan that is secured by a property and senior to any equity, but junior to the senior loan on the property. Preferred Equity. Here is all you need to know about Preferred equity and mezzanine loans for real estate, how they're structured, and how private equity real estate sponsors. Mezzanine financing is a layer of financing that fills the gap between senior debt and equity in a company. It can be structured either as preferred stock.

Debt, equity and mezzanine finance are the three broadest, and most widely available types of alternative funding on offer, and their benefits and drawbacks. Mezzanine financing usually has equity participation in the form of warrants. A convertible structure allows the lender to convert all or a portion of the. Mezzanine debt frequently integrates equity-like features such as warrants or equity kickers, which presents the potential for amplified returns contingent. Preferred equity is similar to preferred stock in the corporate world. It is subordinate to all debt, like junior debt, but superior to common equity. Mezzanine capital is a type of financing that sits between senior debt and equity in a company's capital structure. It is typically used to fund growth. Mezzanine or equity lenders, usually specialist investment funds, will look for a certain rate of return and a possibility of early exit with all the. Mezzanine finance is a hybrid business loan that can usually be converted to equity should the borrower default. In the capital structure of a company, mezzanine finance is a hybrid between equity and debt. Mezzanine financing most commonly takes the form of preferred. MB Capital invests mezzanine capital from in companies that require additional capital outside of conventional debt or equity financing channels. Subordinate debt financing provided to a direct or indirect owner of a Borrower that is secured by a pledge of the direct or indirect equity interest in the. Mezzanine financing is a business loan that offers repayment terms adapted to a company's cash flows. It is a hybrid of debt and equity financing—similar to. Mezzanine financing offers borrowers longer term capital at an affordable price. It gives the lender a higher return than straight debt would provide and. It is a good analogy to mezzanine financing where the term is used to describe capital that has a seniority placement between equity and senior debt financing. Mezzanine & Private Equity. Mezzanine and private equity are tools for corporate growth. When properly deployed, both can increase the value of a company. They. Investment criteria · $20m+ revenue · $2m+ EBITDA · Sponsored/Unsponsored (50/50 split) · Mezzanine debt · 2nd Lien · Unitranche · Preferred equity · equity co-. What is Mezzanine Financing? Definition: “Mezzanine” refers to loans that sit between Senior Debt and Common Equity in a company's capital structure; mezzanine. Mezzanine finance is a type of unsecured business loan that is a mix of two different types of financing: equity and debt products. Mezzanine financing is a fusion of debt and equity financing. It enables a lender to convert debt into equity interest in a business if default should occur. In corporate finance, mezzanine capital generally refers to a tier in a company's capital structure between debt and equity. A mezzanine financing can come in. Mezzanine capital is any subordinated debt or preferred equity instrument that represents a claim on a company's assets which is senior only to that of the.

Bretton Woods History

A short history of the Bretton Woods Monetary System. Created by delegates from 44 countries near the end of World War II, the Bretton Woods system anchored the. In practice, as well as in its origins, Bretton Woods was to show that consistent intentions were more durable than rules. CHANGING THE RULES. The history of. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods System refers to an international monetary order established in , amidst the chaos of World War II. The conference, formally known as the United Nations Monetary and Financial Conference, convened on July 1, , and was attended by delegates. U.S. By an act of the New Hampshire legislature, Bretton Woods is renamed Carroll. The name is revived in as a railroad stop at The Mount Washington Hotel. Summary · The Bretton Woods Agreement established a system through which a fixed currency exchange rate could be created using gold as the universal standard. Bretton Woods Conference The conference was held from July 1 to 22, Agreements were signed that, after legislative ratification by member governments. The Bretton Woods Conference of arose out of the Allies' desire to design a postwar international economic system that would provide a basis for prosperity. A short history of the Bretton Woods Monetary System. Created by delegates from 44 countries near the end of World War II, the Bretton Woods system anchored the. In practice, as well as in its origins, Bretton Woods was to show that consistent intentions were more durable than rules. CHANGING THE RULES. The history of. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods System refers to an international monetary order established in , amidst the chaos of World War II. The conference, formally known as the United Nations Monetary and Financial Conference, convened on July 1, , and was attended by delegates. U.S. By an act of the New Hampshire legislature, Bretton Woods is renamed Carroll. The name is revived in as a railroad stop at The Mount Washington Hotel. Summary · The Bretton Woods Agreement established a system through which a fixed currency exchange rate could be created using gold as the universal standard. Bretton Woods Conference The conference was held from July 1 to 22, Agreements were signed that, after legislative ratification by member governments. The Bretton Woods Conference of arose out of the Allies' desire to design a postwar international economic system that would provide a basis for prosperity.

The Bretton Woods Project is a civil society watchdog of the IMF and World Bank. We advocate for a multilateral system that is democratic, inclusive. The actual story surrounding the historic Bretton Woods accords, however, is full of startling drama, intrigue, and rivalry, which are vividly brought to life. The Bretton Woods Project is a civil society watchdog of the IMF and World Bank. We advocate for a multilateral system that is democratic, inclusive. The two major accomplishments of the Bretton Woods conference were the creation of the International Monetary Fund (IMF) and the International Bank for. The Bretton Woods Conference, officially known as the United Nations Monetary and Financial Conference, was a gathering of delegates from 44 nations that met. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. Bretton Woods is the newest major ski area in New England. Its high base elevation and wind-protected exposure results in unique conditions for the region. In , representatives of 44 nations met at Bretton Woods, New Hampshire, and designed a new postwar international monetary system. This system advocated the. The aim of the Bretton Woods Conference was the creation of a dynamic world community in which the peoples of every nation will be able to realize their. In , the Bretton Woods Agreements introduced a gold standard system that transformed the US dollar into an international reserve currency, the only one. The Bretton Woods system was drawn up and fixed the dollar to gold at the existing parity of US$35 per ounce, while all other currencies had fixed, but. Related Links · End of Bretton Woods system. The system dissolved between and · Oil shocks. Many feared that the collapse of the Bretton Woods system. Omni Mount Washington Resort History Bretton Woods is part of a land grant made in by Royal Governor John Wentworth. The area was named after Bretton. The Bretton Woods Committee is the preeminent non-profit organization dedicated to effective global economic and financial cooperation. The Bretton Woods Project at the CFS offers many photographs of historic figures at this iconic conference. Similarly, the Project seeks to build a living. The United States government selected the Mount Washington Hotel as the site of the now famous Bretton Woods Conference for various reasons: its remoteness. The Bretton Woods system was intended to resolve the problems that plagued the old interwar gold standard. Though, in an inauspicious sign for. The Bretton Woods system of monetary management, created at a conference in , established the rules for commercial and financial relations among the world's. Bretton Woods Conference, meeting at Bretton Woods, New Hampshire (July 1–22, ), during World War II to make financial arrangements for the postwar world. A remarkably deft work of storytelling that reveals how the blueprint for the postwar economic order was actually drawn, The Battle of Bretton Woods is destined.

Treasure Bond Yield

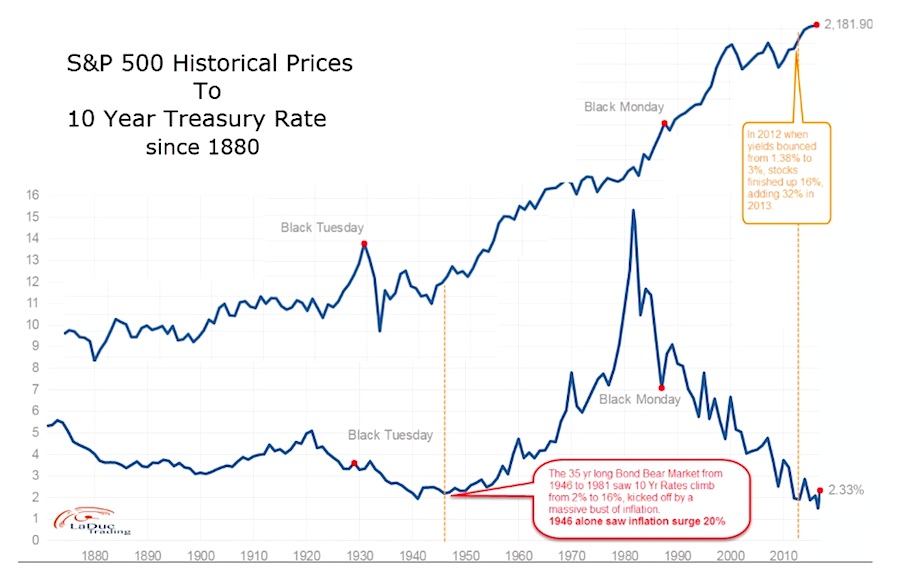

Treasury yield is the effective annual interest rate that the U.S. government pays on one of its debt obligations, expressed as a percentage. Treasury securities ; One-Year CMT (Monthly), , , ; One-Year Treasury Constant Maturity, , , 2-year Treasury yield retreats after $69 billion auction sees strong demand. Short-dated Treasury yields fell on Tuesday following a strong auction of 2-year. Bond yields and prices share a negative correlation. When a bond's yield rises, its price falls. This is based on the loanable funds theory: bond issuance. Treasury bonds (T-bonds) are fixed-rate U.S. government debt securities with a maturity of 20 or 30 years. · T-bonds pay semiannual interest payments until. Get our 10 year Treasury Bond Note overview with live and historical data. The yield on a 10 yr treasury bill represents the return an investor will receive. Daily Treasury Bill Rates · Daily Treasury Long-Term Rates · Daily Treasury Real Long-Term Rates · Treasury Coupon-Issue and Corporate Bond Yield Curve. Daily Treasury Par Yield Curve Rates · Daily Treasury Par Real Yield Treasury Coupon-Issue and Corporate Bond Yield Curve · Treasury Coupon Issues. Bonds market data, news, and the latest trading info on US treasuries and government bond markets from around the world. Treasury yield is the effective annual interest rate that the U.S. government pays on one of its debt obligations, expressed as a percentage. Treasury securities ; One-Year CMT (Monthly), , , ; One-Year Treasury Constant Maturity, , , 2-year Treasury yield retreats after $69 billion auction sees strong demand. Short-dated Treasury yields fell on Tuesday following a strong auction of 2-year. Bond yields and prices share a negative correlation. When a bond's yield rises, its price falls. This is based on the loanable funds theory: bond issuance. Treasury bonds (T-bonds) are fixed-rate U.S. government debt securities with a maturity of 20 or 30 years. · T-bonds pay semiannual interest payments until. Get our 10 year Treasury Bond Note overview with live and historical data. The yield on a 10 yr treasury bill represents the return an investor will receive. Daily Treasury Bill Rates · Daily Treasury Long-Term Rates · Daily Treasury Real Long-Term Rates · Treasury Coupon-Issue and Corporate Bond Yield Curve. Daily Treasury Par Yield Curve Rates · Daily Treasury Par Real Yield Treasury Coupon-Issue and Corporate Bond Yield Curve · Treasury Coupon Issues. Bonds market data, news, and the latest trading info on US treasuries and government bond markets from around the world.

Current benchmark bond yields · 2 year - , % (); · 3 year - , % (); · 5 year - , % (); · 7.

Open % · Day Range - · 52 Week Range - · Price 99 8/32 · Change /32 · Change Percent % · Coupon Rate % · Maturity Aug US 2 Year Note Bond Yield was percent on Tuesday August 27, according to over-the-counter interbank yield quotes for this government bond maturity. Yield. Treasuries usually offer lower yields than other fixed income securities because their minimal risk makes them among the safest investments available. The S&P U.S. Treasury Bond Index is a broad, comprehensive, market-value weighted index that seeks to measure the performance of the U.S. Treasury Bond. U.S. 10 Year Treasury US10Y:Tradeweb ; Yield Open% ; Yield Day High% ; Yield Day Low% ; Yield Prev Close% ; Price United States Treasury security United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United. The yield on a Treasury bill represents the return an investor will receive by holding the bond to maturity, and should be monitored closely as an indicator of. US 10 Year Note Bond Yield was percent on Wednesday August 28, according to over-the-counter interbank yield quotes for this government bond maturity. US 10 year Treasury · Yield · Today's Change / % · 1 Year change%. US Treasury Yield Curve ; 3 Mth. , ; 6 Mth. , ; 1 YR. , ; 2 YR. , Treasury bill yields presented are an average of sample secondary market yields taken throughout the business day. The rate is fixed at auction. It does not vary over the life of the bond. It is never less than %. See Interest rates of recent bond auctions. 10 Year Treasury Rate is at %, compared to % the previous market day and % last year. This is lower than the long term average of %. Treasury note and bond data are representative over-the-counter quotations as of 3pm Eastern time. For notes and bonds callable prior to maturity, yields. Find the latest Treasury Yield 30 Years (^TYX) stock quote, history, news and other vital information to help you with your stock trading and investing. View a year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. The 1 year treasury yield is included on the shorter end of the yield curve and is important when looking at the overall US economy. Historically, the 1 year. Price Yield Calculator ; Modified Duration, years ; Spread of ACF Yield (%) over yr Treasury Yield (%) As of 08/26/24 is + 11 bps. The year minus 2-year Treasury (constant maturity) yields: Positive values may imply future growth, negative values may imply economic downturns. Key Data ; Open%. Day Range ; 52 Wk Range - Price ; Change-1/ Change Percent ; Coupon Rate%. Maturity.

Jumbo Money Market

Jumbo Money Market Account Rates ; $0 - $49,, %, % ; $50, and up*, %, %. Our Relationship Plus Money Market account is a savings account that gives you access to a competitive interest rate. With a % APY6 on balances of $, or greater, the Jumbo Money Market allows you to grow your savings while having the flexibility to access your funds. Key Select Money Market Savings · Earn % interest rate (% blended APY) for 6 months. See how · Rate available on balances of $25, to $1,, with. Performance Money Market, %, %, $, +. Jumbo Money MarketJumbo Money Market. Jumbo Money Market Savings · Competitive, tiered rates on higher balances* · Higher balances earn higher dividends · Dividends are paid monthly · No monthly. With SBT's Jumbo Money Market Account, you can put away some money in an interest-bearing account, then withdraw those funds whenever you need them. Jumbo Money Market Account If you have balances of $, or more and still want the flexibility of having access to your funds, this account is for you. Jumbo Money Market Account Rates. $, to open. $1, min to earn and skip $10/mo fee. $0-$99, %. $,+. %. High Yield Money Market. Jumbo Money Market Account Rates ; $0 - $49,, %, % ; $50, and up*, %, %. Our Relationship Plus Money Market account is a savings account that gives you access to a competitive interest rate. With a % APY6 on balances of $, or greater, the Jumbo Money Market allows you to grow your savings while having the flexibility to access your funds. Key Select Money Market Savings · Earn % interest rate (% blended APY) for 6 months. See how · Rate available on balances of $25, to $1,, with. Performance Money Market, %, %, $, +. Jumbo Money MarketJumbo Money Market. Jumbo Money Market Savings · Competitive, tiered rates on higher balances* · Higher balances earn higher dividends · Dividends are paid monthly · No monthly. With SBT's Jumbo Money Market Account, you can put away some money in an interest-bearing account, then withdraw those funds whenever you need them. Jumbo Money Market Account If you have balances of $, or more and still want the flexibility of having access to your funds, this account is for you. Jumbo Money Market Account Rates. $, to open. $1, min to earn and skip $10/mo fee. $0-$99, %. $,+. %. High Yield Money Market.

The best money market accounts are offering up to % APY from First Internet Bank and % APY from Vio Bank. Get the EverBank Performance Money Market account, which can help you save toward important financial and life goals, while providing other perks along the. Santander Select® Money Market Savings · Monthly Fee · Minimum balance · ATM withdrawal fee · Account opening deposit · Interest · Statement delivery options. Savings | Investments ; Jumbo Money Market Savings Account, % ; Money Market Savings Account, % ; Individual Retirement Savings Account (IRA), %. Earn higher dividends on your savings and easily access to your funds with a Jumbo Money Market account. Call us or visit a branch today to open yours. Grow your wealth without sacrificing your financial flexibility, with a Comerica High Yield Money Market Investment Account (HYMMIA). Get rewarded for your large sum deposits. A Bank5 Connect Jumbo Savings account provides you with a top-of-market APY* and the peace of mind that every single. A jumbo certificate of deposit is a CD that requires a higher minimum balance obligation than that required by traditional CDs. Jumbo Money Market A $, minimum balance is required to open. Dividends calculated on daily balance, compounded daily and credited to account at month. These accounts, called jumbo money market accounts, are worth looking into if you're looking to deposit a large sum into a liquid account. Always make sure you'. Jumbo MMSA: To open a Jumbo MMSA, you must first be a member of. Navy Federal (i.e., own a savings account with a $ minimum balance). Are you looking for more from your savings? Then you need the new Jumbo Money Market from PMCU. Earn up to % APY*, minimum balance $K. Jumbo Money Market Account and Money Market Account APY = Annual Percentage Yield. Rates are subject to change without notice. The rates may change after. Money Management Savings and Jumbo Money Management Savings accounts are tiered rate accounts. Once a particular range is met, the dividend rate and annual. For a jumbo money market account, First Internet Bank is paying one of the highest rates right now: % APY on balances above $1,, Jumbo Money Market account, a tiered variable rate account, requiring a Dividends are calculated and accrued daily, based on the Jumbo Money Market balance. 's Best Credit Union Jumbo Money Market Rates ; High-Yield, Greenwood Credit Union Premier Money Market, % - % ; With Branch Access, Canvas Credit. Jumbo Money Market account: Earn more on your high-balance savings without losing flexibility. Whether you're saving for retirement, a new home, or any other. With our Elite Money Market Account, you'll enjoy all the benefits of a traditional checking account, but with tiered interest rates that may pay more for. Travis Credit Union's Money Market Accounts give you the best of both worlds. Earn higher interest than basic savings accounts along with the convenience of.

How Much Does It Cost To Hire Painters For Interior

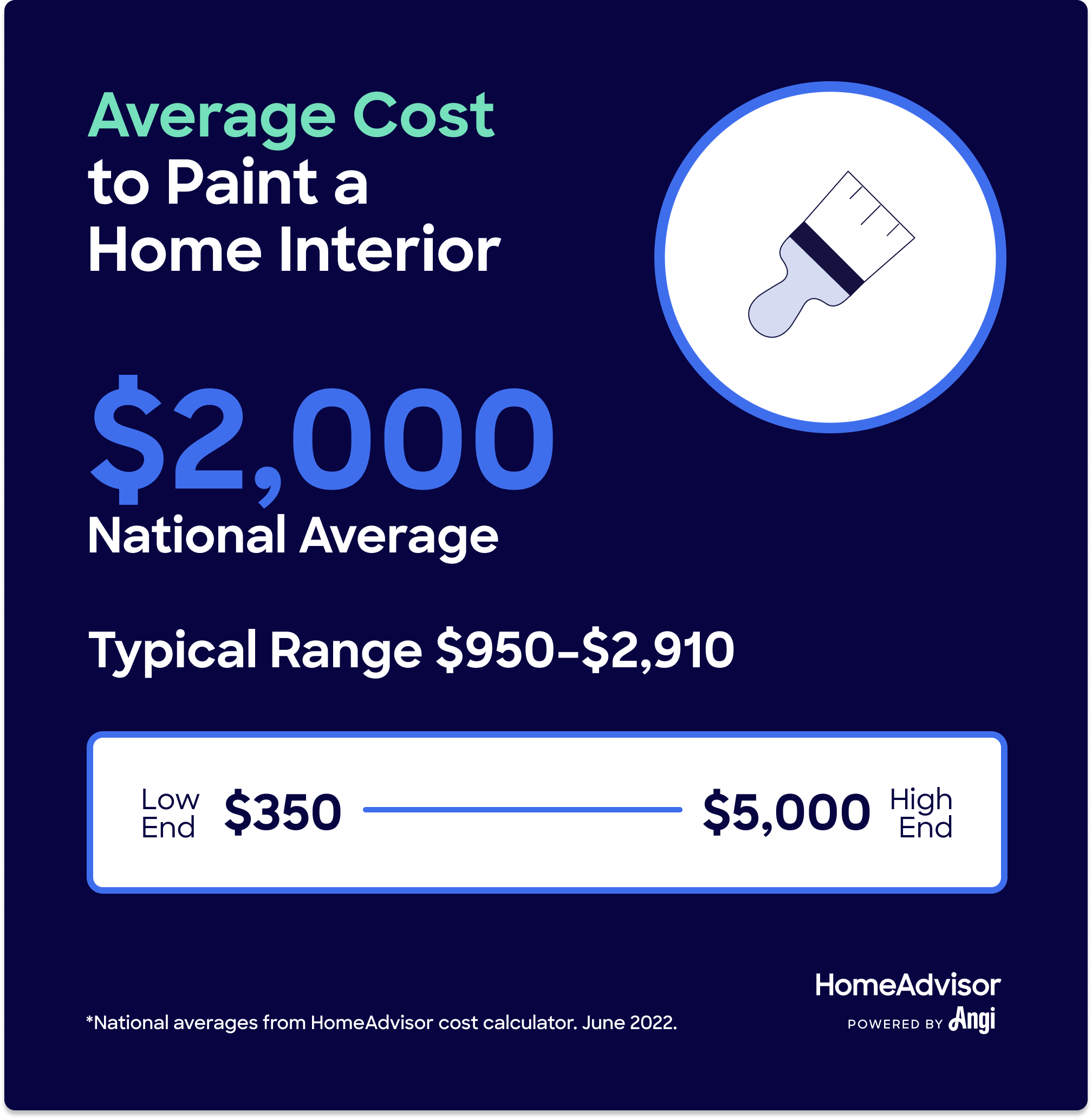

What do most painters charge per hour? anywhere from $20 to $50 per hour, depending on their skills and experience? · Most professional house painters charge by. Lastly, according to This Old House “If you hire interior painters to do the job for you, the national average cost can range between $1, and $10, Professional Painter Prices. Most professional painters charge $2 to $6 per square foot of paintable area. Less commonly, they'll charge. Painters charge anywhere from $$40 per hour, depending on how easy or complicated the project at hand is. Painters with less experience tend to charge less. A professional exterior house painting costs somewhere between $ and $4 per square foot, but the final cost depends on several other factors. Small Interior Bathroom Painting 6 x 6 ; *Wall Painting, Sq Ft, $ ; Ceiling Painting, 36 Sq Ft, $ ; Door and Casing, Per Side, $ ; Baseboard, The average painting cost per square foot usually runs from $ – $ for interior house painting. How much does it cost to paint a square foot house. HomeAdvisor's Painting Cost Guide gives prices for paint and hiring a painter. Estimate pricing for painting interiors or exteriors, fences, and other. On average, you can expect to pay anywhere from $25 to $ per hour for labor. Additionally, most painters charge per square foot, and the cost. What do most painters charge per hour? anywhere from $20 to $50 per hour, depending on their skills and experience? · Most professional house painters charge by. Lastly, according to This Old House “If you hire interior painters to do the job for you, the national average cost can range between $1, and $10, Professional Painter Prices. Most professional painters charge $2 to $6 per square foot of paintable area. Less commonly, they'll charge. Painters charge anywhere from $$40 per hour, depending on how easy or complicated the project at hand is. Painters with less experience tend to charge less. A professional exterior house painting costs somewhere between $ and $4 per square foot, but the final cost depends on several other factors. Small Interior Bathroom Painting 6 x 6 ; *Wall Painting, Sq Ft, $ ; Ceiling Painting, 36 Sq Ft, $ ; Door and Casing, Per Side, $ ; Baseboard, The average painting cost per square foot usually runs from $ – $ for interior house painting. How much does it cost to paint a square foot house. HomeAdvisor's Painting Cost Guide gives prices for paint and hiring a painter. Estimate pricing for painting interiors or exteriors, fences, and other. On average, you can expect to pay anywhere from $25 to $ per hour for labor. Additionally, most painters charge per square foot, and the cost.

What do most painters charge per hour? anywhere from $20 to $50 per hour, depending on their skills and experience? · Most professional house painters charge by. The price you'll pay to hire interior painters will depend on factors such as the size of your space, the amount of prep work they'll have to do, and the type. The basic cost to Paint a Home is $ - $ per square foot in April , but can vary significantly with site conditions and options. Likewise, the average cost for an interior painting project can range from $ to $1, or more, depending on how much work is needed and how extensive the. To paint a room, a low-end painter may only charge you between $ and $ It may work for one-room projects, but maybe you want to paint all the walls in. At Singletrack Painting, our rates start at around $ to paint walls in a standard sized bedroom. Just remember that the pricing doesn't include painting trim. A 4, square feet interior painting job will usually cost around $6, to $12, The exact price depends on several factors such as the materials, time of. A fair hourly rate for a painter is somewhere between $40 and $80 per hour. The million dollar question is whether it is worth it to hire a professional painter. INTERIOR HOUSE PAINTING PRICING GUIDE ; Standard Bathroom · Sq Ft, $ ; Standard Bedroom · Sq Ft, $ ; Large Living Room · Sq Ft, $ So the painting estimate for a 1,square-foot house would be anywhere from $3,$5, plus HST. This is interior painting costs. Ceilings can cost between. Interior painting cost per hour and exterior painter cost per hour are usually the same, ranging from $25 to $ per hour and per painter. Therefore, two. So the painting estimate for a 1,square-foot house would be anywhere from $3,$5, plus HST. This is interior painting costs. Ceilings can cost between. Interior House Painting Pricing Guide ; Standard 5×8 Bathroom · Sq Ft, $ ; Standard 12×12 Bedroom · Sq Ft, $ ; Large 18×24 Living Room. Hiring a local painter to tackle your interior painting project is the easiest way to get the job done quickly, neatly and with the best possible results. A. Currently, the average cost to hire a professional painter is $20 to $50 per hour. This is prone to changes based on the project's difficulty and the painter's. Hiring a local painter to tackle your interior painting project is the easiest way to get the job done quickly, neatly and with the best possible results. A. How Much Does Interior Painting Cost? ; Baseboard, 24 Ln Ft, $ ; Small Room 10 x 12, *Wall Surface, Sq ft, $ The average interior painting project will cost between $ and $1, The room's square footage, local labor cost, ceiling height, the complexity of the trim. House interior painting: by footage size. Based on common interior square footage sizes, interior painting jobs national average rate is $2-$5 per square foot. The average cost to paint a commercial building If you're looking for a quick and easy answer regarding the average cost for commercial painting projects, the.

Ucd Cs Master

UCD is very good for masters in computer science. The infrastructure and facilities are really good. There is more emphasis on practical. Graduate students are working toward a master's or doctoral degree. Students must be admitted as a graduate student in order to earn a degree. This part-time masters programme is designed for experienced software engineers who wish to advance their skillset in areas of computer science and software. Modeled after UC Davis' highly regarded MBA program, the online Master of Master's Degree in Computer Science · see more Graduate Degrees · see more. Design your future career with a graduate or undergraduate degree from the UCF College of Engineering and Computer Science. Davis is considered a suburb and offers tranquility and safety near the excitement of a city center. Undergraduate Degrees. 86 Graduate Degrees. MSc Computer Science (Negotiated Learning) a customised programme of study which meets individual student needs and prior learning experiences. Explore This School's Science School · Colleges · Graduate Schools · Online Programs · Global Universities. UC Davis is a very good school to attend an MS CS and should help your career. It is ranked regularly between the top schools in the US. UCD is very good for masters in computer science. The infrastructure and facilities are really good. There is more emphasis on practical. Graduate students are working toward a master's or doctoral degree. Students must be admitted as a graduate student in order to earn a degree. This part-time masters programme is designed for experienced software engineers who wish to advance their skillset in areas of computer science and software. Modeled after UC Davis' highly regarded MBA program, the online Master of Master's Degree in Computer Science · see more Graduate Degrees · see more. Design your future career with a graduate or undergraduate degree from the UCF College of Engineering and Computer Science. Davis is considered a suburb and offers tranquility and safety near the excitement of a city center. Undergraduate Degrees. 86 Graduate Degrees. MSc Computer Science (Negotiated Learning) a customised programme of study which meets individual student needs and prior learning experiences. Explore This School's Science School · Colleges · Graduate Schools · Online Programs · Global Universities. UC Davis is a very good school to attend an MS CS and should help your career. It is ranked regularly between the top schools in the US.

University College Dublin MSc Computer Science course fees, scholarships, eligibility, application, ranking and more. Know How to get admission into. The U.S. News & World Report ranked UC Davis 37th for computer science and 31st for engineering. On Niche, UCD boasts America's 94th best computer science. UC San Diego's online Master of Data Science provides working professionals the skills they need to get ahead or transition into the field of data science. Contact. Ms. Xu. Email: [email protected] Tel: + History. Computer Science (CS) programs at Fudan University have more than 60 years of. UC Davis`s College of Engineering offers Master of Science in Computer Science Degree program. The duration of this program is 18 months. Our Bachelor of Science in Computer Science degree introduces you to a scientific and practical approach to computation and its applications. How is UCD Computer Science Masters program? Hello,. I got admitted into UCD and UCSC for Masters in CS for Fall. I'm unable to decide which. The Computer Science & Engineering program offers a Master of Science degree, and a Doctoral degree. graduate study at the University of California, Santa. 72 students received their master's degree in computer science from UC Davis. This makes it the #51 most popular school for computer science master's degree. The University of California Davis MS in CS is a 2-year program offered on full-time basis; The Master of Science (MS) in Computer Science program at the. University College Dublin, UCD School of Computer Science Masters Degrees · MSc Human Computer Interaction (Full-Time) · GradCert Forensic. The master of science in computer science requires a minimum of 30 credit hours of graduate-level computer science courses with at least a grade point. All students who have completed a bachelor's degree in computer science or a closely related field are eligible to apply to the PhD in computer science. The MS in Computer Science degree program at UT Dallas offers intensive preparation in design programming, theory and applications. In the Master of Science in Computer Science program, there are five possible research groups including: The Data and Knowledge Management Group studies the. DePaul graduate programs are designed to fit into your schedule. We offer courses during the day, at night and online. Our faculty are among the best. ECE MS Degree Options. Introduction to COE and ECE. Master's students in the College of Engineering (COE) are among an elite group of people who have chosen. Rice University's Online Master of Computer Science program has been built from the ground up to combine the top-ranked Rice Computer Science Department's. Find every English-taught Master's degree from University of California, Davis, organised by subjects and best info to help you select the right degree.

How To Analyse A Stock Chart

Chart analysis is a way to analyze financial markets by studying historical price and volume data. It is based on the idea that market trends, patterns, and. Charts are the graphical representation of a security's price, volume, history and time intervals. This is where you get patterns of candlesticks, hammers and. In this article, we will tell you how to read stock charts, what parameters are included in the stock price, and how stock candlesticks and bars are drawn. How Stock Chart Helps You in Your Analysis? · The stock chart record the price and volume data history to help you to determine whether the stock value is. Understanding the Chart. Before diving into the analysis, let's familiarize ourselves with the key elements of a stock price chart. · Key. Charts also help technical analysts to decide on entrance and exit points, and at what prices to place stops to reduce risk. The main chart types used by. Here are some key steps to help you analyze a stock chart effectively: 1. Select a Chart Timeframe: Start by choosing a timeframe for the chart. Free, award-winning financial charts, trading tools, analysis resources, market scans and educational offerings to help you make smarter investing. Fundamental analysis attempts to identify stocks offering strong growth potential at a good price by examining the underlying company's business, as well as. Chart analysis is a way to analyze financial markets by studying historical price and volume data. It is based on the idea that market trends, patterns, and. Charts are the graphical representation of a security's price, volume, history and time intervals. This is where you get patterns of candlesticks, hammers and. In this article, we will tell you how to read stock charts, what parameters are included in the stock price, and how stock candlesticks and bars are drawn. How Stock Chart Helps You in Your Analysis? · The stock chart record the price and volume data history to help you to determine whether the stock value is. Understanding the Chart. Before diving into the analysis, let's familiarize ourselves with the key elements of a stock price chart. · Key. Charts also help technical analysts to decide on entrance and exit points, and at what prices to place stops to reduce risk. The main chart types used by. Here are some key steps to help you analyze a stock chart effectively: 1. Select a Chart Timeframe: Start by choosing a timeframe for the chart. Free, award-winning financial charts, trading tools, analysis resources, market scans and educational offerings to help you make smarter investing. Fundamental analysis attempts to identify stocks offering strong growth potential at a good price by examining the underlying company's business, as well as.

Stock chart patterns are lines and shapes drawn onto price charts in order to help predict forthcoming price actions, such as breakouts and reversals. They are. Technical analysis focuses on market action – specifically, volume and price. Technical analysis is only one approach to analyzing stocks. When considering. Understanding this trading chart is simple, if the left dash (which is open price) is lower than the right dash (closing price) then the bar will be shaded in. Bar charts are used to plot price movements over a specific period, usually a day or week. These charts, sometimes called high/low charts, consist of a vertical. Moving Average Lines: The red line shows the average share price during the last 50 days (on a daily chart) or 10 weeks (on a weekly chart) of trading. The. How To Use ChatGPT To Analyze A Stock · 1. Gain a high-level understanding of a company · 2. Perform a SWOT analysis · 3. Summarize earnings calls · 4. Evaluate a. The Dow theory on stock price movement is a form of technical analysis. Crossover is the point on a stock chart when a security and an indicator intersect. Before moving on to the analysis part, you want to make sure your charts are "clean" - i.e. that you only have the technical indicators on the chart that are. What are charts in technical analysis? · Charts are a graphical representation of prices and volumes. · They help identify patterns, formations and trends. Technical traders analyze price charts to attempt to predict price movement. The two primary variables for technical analysis are the time frames considered and. On the top left you will find the name of the company, its stock symbol (also called the Ticker), and the name of the exchange on which the share trades. Chart. There are two primary methods of analyzing stocks: technical analysis and fundamental analysis. Technical analysis shows how a stock's price swings, but doesn'. In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data. Where to Find Free Stock Charts · TradingView · TradingView is undoubtedly one of the most popular charting platforms available online. · Yahoo Finance. Yahoo. Stock chart patterns, when identified correctly, can be used to identify a consolidation in the market, often leading to a likely continuation or reversal trend. Charts provide information about past price behavior and provide a basis for inferences about likely future price behavior. Basic charts include line charts. The most common types of stock charts used by investors are line charts, bar charts and candlestick charts. Each stock chart type will illustrate the past. used a line chart. Line charts only provide one data point, the closing price of a stock, but candlestick charts provide five: open, close, low of day (LOD). Chart patterns are a commonly-used tool in the analysis of financial data. Analysts use chart patterns as indicators to predict future price movements. Technical analysis for stocks uses data on past movements in stock price and overall market sentiment in an attempt to predict the future change in a stock's.

Have Mortgage Rates Dropped Today

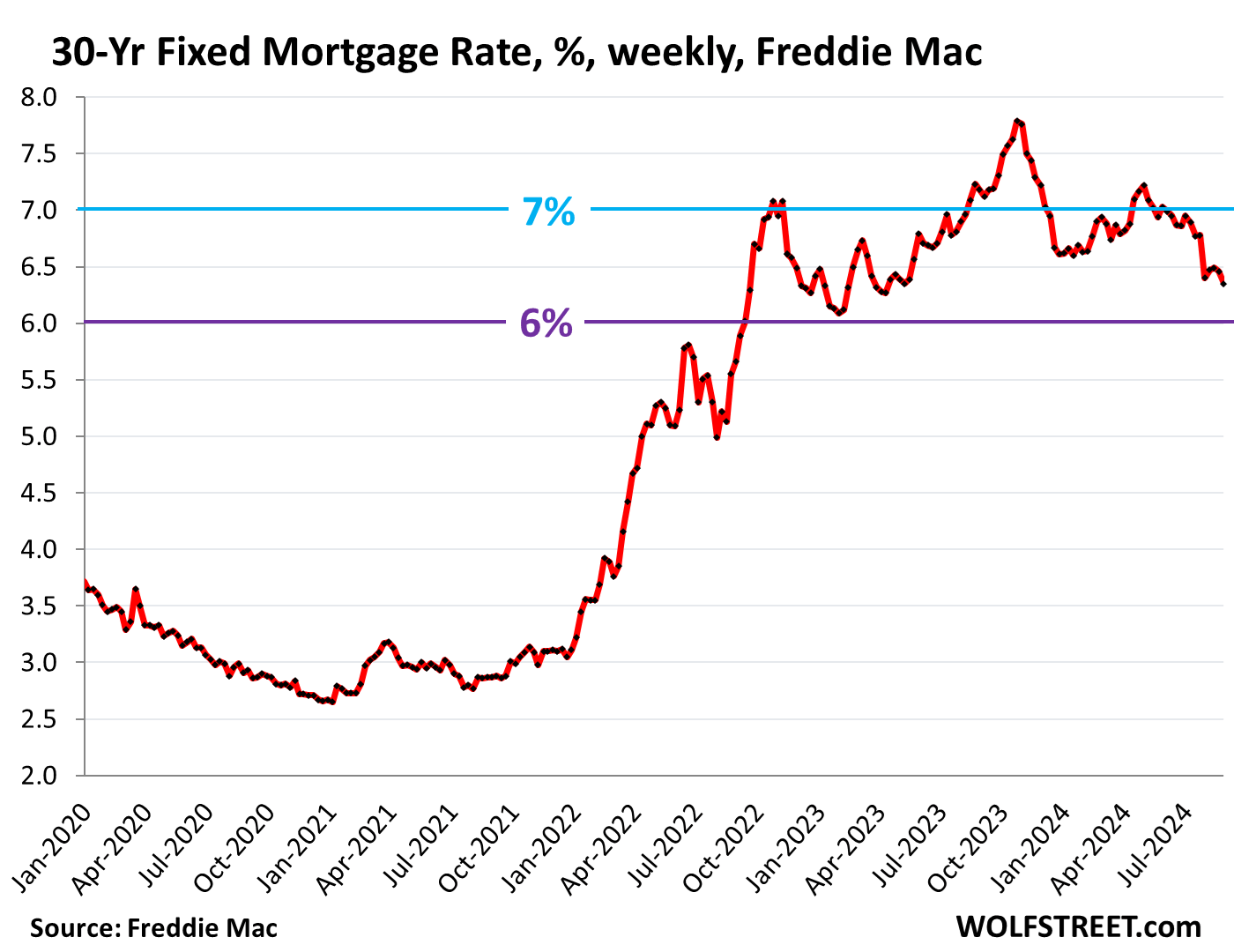

The index is generally updated once per day unless multiple lenders have changed rates during the day. Today's Mortgage Rates | Mortgage Calculators · 8/30/. Interest rates have fallen 46bps in the last five weeks, tracking a decline in Treasury yields amid bets the Fed will start cutting interest rates next month. Mortgage rates today should remain in their narrow range, with some downward pressure. Rising treasury bond yields partially caused the small interest rate. With rates around 7% for a year fixed-rate mortgage, there's no denying that financing a home is more expensive in than it was over the previous few. What Are Today's Average Mortgage Rates? ; year fixed-rate mortgage: · The average APR for the benchmark year fixed mortgage fell to %. · %. ; year. As of August 28, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and significantly. Additionally, the economy showing signs of slowing has many experts believing mortgage interest rates will gradually descend in Today's mortgage rates. Today's Locked Mortgage Rates ; YR. CONFORMING. % ; YR. CONFORMING. % + ; YR. JUMBO. % − ; YR. FHA. % − Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt you have compared to your income and. The index is generally updated once per day unless multiple lenders have changed rates during the day. Today's Mortgage Rates | Mortgage Calculators · 8/30/. Interest rates have fallen 46bps in the last five weeks, tracking a decline in Treasury yields amid bets the Fed will start cutting interest rates next month. Mortgage rates today should remain in their narrow range, with some downward pressure. Rising treasury bond yields partially caused the small interest rate. With rates around 7% for a year fixed-rate mortgage, there's no denying that financing a home is more expensive in than it was over the previous few. What Are Today's Average Mortgage Rates? ; year fixed-rate mortgage: · The average APR for the benchmark year fixed mortgage fell to %. · %. ; year. As of August 28, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and significantly. Additionally, the economy showing signs of slowing has many experts believing mortgage interest rates will gradually descend in Today's mortgage rates. Today's Locked Mortgage Rates ; YR. CONFORMING. % ; YR. CONFORMING. % + ; YR. JUMBO. % − ; YR. FHA. % − Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt you have compared to your income and.

September mortgage rates currently average % for year fixed loans and % for year fixed loans. Find your best mortgage rates · Get the lowest. Have you been putting off buying a home, hoping that mortgage rates will drop? With our easy, no-refi rate drop, you can buy a home now and if our rates drop. For example, if you were to get approved for a year fixed-rate loan at % interest rate, your interest rate would not change again, regardless of the. The lenders I spoke to advised against doing so at the moment, since rates are expected to drop anyway. have a better rate. Those kids or. View today's mortgage rates in your area and get a personalized quote in minutes. Rates decrease | Current mortgage rates for September 13, Today's average year fixed-mortgage rate is , the average rate for a year fixed. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Today's Rate on a Year Fixed Mortgage Is % and APR % · View Advertising Loan Disclosures. In a year fixed mortgage, your interest rate. Meanwhile, the average APR for a 15 year fixed-rate mortgage increased by 1 basis point to %, and the average APR for a 5-year Adjustable Rate Mortgage . This drop coincides with a decline in long-term Treasury yields, as ongoing apprehensions regarding economic growth in the US have led investors to gravitate. Mortgage rates continue to hover near the lowest levels of the year. The year fixed rate currently sits at %, % APR with points. Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until Today's mortgage interest rates fall for year terms while year terms Here are today's mortgage rates and what you need to know about getting the best. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Get the latest on mortgage rate trends this week. The average year fixed mortgage rates decreased this week, averaging %, compared to % last. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. The amount of home equity you can borrow is tied directly to the interest rate available when you get your reverse mortgage. dropped as a financial. This has meant there has been continued volatility in the market despite the base rate remaining the same for much of the last year. Will mortgage rates fall or. On the week of September 2, , the current average interest rate for a year fixed-rate mortgage decreased 11 basis points from the prior week to %. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term.

1 2 3 4